Commodity producers in Japan experience sharp decline in revenues and profits for 3Q

Day in Review

South Korea

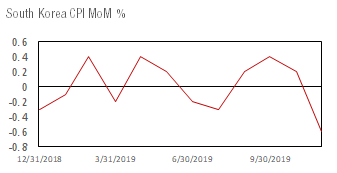

Inflation in South Korea was down -0.6% for the month of November on a monthly basis but up 0.2% on a yearly basis. Estimates for the month of November set the inflation rate change at 0.1%.

The November figure is the highest decrease in 2019. The average monthly inflation year to date is around 0%.

The decrease in prices was driven by a drop in prices across several categories: alcoholic beverages and tobacco down -0.3%, recreation and culture products & services down -1.7%, communications down -0.8%, food and nonalcoholic beverages down -2.6%, furnishings and household equipment down -0.8% and transport down -0.5%.

These categories most likely benefited from the decline in commodities prices down -1%, particularly agricultural commodity prices which were down -4.5% as well as energy prices down -0.3%.

Japan

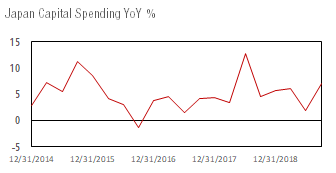

Capital spending for the 3rd quarter of 2019 was up 7.1% coming higher than survey expectations of 5%. Manufacturing related capital spending was up 6.4% while non-manufacturing spending was up 7.6%.

Manufacturing spending’s highest increases were across business machinery sector up 40.4%, information and communications up 18.9%, and production machinery and machine parts sector up 18.6%.

On the non-manufacturing side, the largest increases in capital spending were across real estate agencies up 23.7%, wholesale and retail trade up 17.1% and goods rental and leasing up 12%.

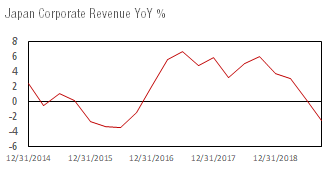

Corporate revenues for the 3rd quarter of 2019 were down -2.6% year over year hitting a low for 2019 and the lowest since the 3rd quarter of 2016. Corporate revenues were down across manufacturing and non-manufacturing companies.

Across manufacturing business categories, the largest decline in revenues was recorded amongst manufacturers of information and electronics products which saw their revenues down -18.9% year over year.

On the non-manufacturing side, the largest decline in corporate revenues was recorded within the construction sector with revenues down -8.6% year over year.

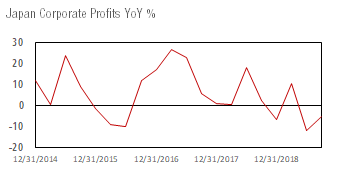

Corporate profits for the 3rd quarter of 2019 were down -5.3% year over year coming below survey expectations of -2%.

The decline in profits was particularly strong for manufacturers of steel and iron products which saw their profits drop -99.1% year over year, similarly, manufacturers of petroleum and coal products saw their profits drop by -88.5% year over year.

Overall the manufacturing sector’s profits declined by -15.1% year over year.