Mixed numbers from Europe and Asia show gloomy picture ahead

The UK economy didn’t grow in the month of July as the latest GDP growth figures show. The GDP growth for July stood at 0% recovering from a drop of -0.2% in the previous month. The European economy has struggled since the Brexit vote. The UK averaged a monthly GDP growth of around 0.21% year to date. It’s likely the headwinds ahead will bring more trouble as no solution to the Brexit stand still has been found yet. The UK’s industrial production rose 0.1% for the month of July, with manufacturing rising by 0.3% while oil and gas, mining and electric and gas production sliding -2.5%, -1.2% and -1.4% respectively. Construction output also increased by 0.3% year over year from last month’s drop of -0.2%. New construction work was up 2.3% year over year, an increase from last month’s 1.9%. Repair and maintenance construction work continued to slide, recording a drop of -3.5% for the month of July.

CPI figures for the month of August show inflation in China at around 2.8% unchanged from last month’s figure. Production Price Index posted another decrease of -0.8% for the month of August, deepening the drop from last month’s -0.3% decrease, a trend of decreases in production starting from April of this year.

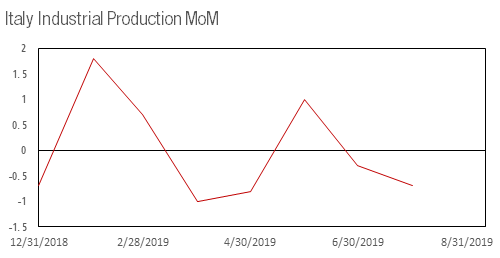

In France, private sector total payrolls grew 0.2% for the second quarter of the year, down from the increase of 0.3% of last quarter. The 2nd quarter’s figure came below economist expectations, with a panel survey putting growth in private payrolls for the 2nd quarter at 0.3%. Industrial production was up 0.3% month over month and manufacturing production was up 0.3% as well. While in Italy, Industrial production for the month of July was down -0.7%. The largest drop in production figures was in the Pharmaceutical sector which saw its production for the month of July drop by -7.5% month over month. Followed by the machinery and equipment manufacturers dropping -3.0%. The largest production growth was in the mining and quarrying sector which saw a 4.0% month over month increase in production.

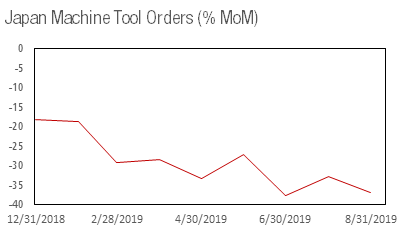

Japan’s machine tool orders decreased by -37.1% year over year, a higher decrease than last month’s -33.0% drop. Machine tool orders in Japan have been decreasing compared to last year since the start of 2019. The year to date average YoY orders change is around -29.3%. But this month’s reading below the annual average is a sign of increasing pressure on the manufacturing sector and loss of risk appetite likely to lead to drops in capex and investments in the Japanese manufacturing sector.

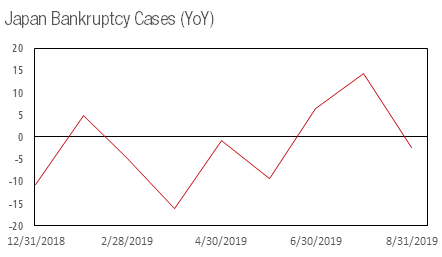

Bank lending was up 2.1% year over year for the month of August. Major banks lending increased by 2.2% year over year, regional banks lending increased by 2.3% while Shinkin banks (cooperative banks) increased their lending by 1.2%. Foreign banks lending was up 16.2% year over year. Bankruptcy cases were down -2.3%, following a month of July were the bankruptcy cases were up 14.24%. Sector wise, the construction sector bankruptcy cases were down -10.31%, Manufacturing cases were down -18.27% and real estate services bankruptcy cases were down -35.48%. On the other hand, retail bankruptcy cases continued to increase and were up 38.04% year over year for the month of August reporting a higher figure for the month than last month’s 18.01% increase. The transportation and communication sectors also reported increases in bankruptcy cases, with transportation sector up 31.57% and communication sector up 7.14%.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/kz/register?ref=RQUR4BEO

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.