Oil in mixed territory as US national security advisor ousted

South Korea

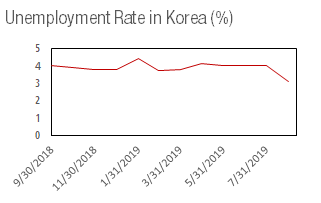

• South Korean economy’s unemployment rate dropped to the lowest level since 2013. The unemployment rate for the month of August was 3.1% lower from last month’s 4% figure. The Asian economy added 452,000 jobs for the same period of last year.

USA

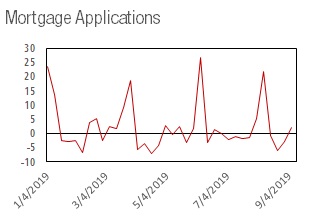

• In the United States, the number of mortgage application picked up last week and recorded an increase of 2% from last period. The week before saw a decrease in the number of mortgage applications of -3.1%. This increase follows a series of weeks were the mortgage application was sliding. The figure is nevertheless much lower than the last positive figure from early August standing at 21.7%. The decrease was likely due to uncertainty regarding interest rates changes.

• The producer price index was up both on a year over year and month over month basis. The index recorded an increase of 0.1% month over month and 1.8% year over year. Inventories were also up with wholesale inventories up 0.2% over the past month. As for the wholesale trade sales, they were also up 0.3% month over month.

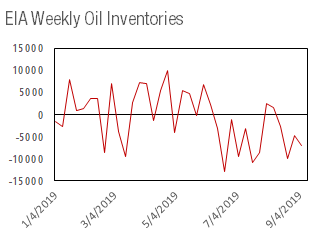

• On the energy side, weekly EIA data showed a decrease in U.S Crude oil inventories down 6.9 million barrels continuing a trend of decreases in U.S crude oil inventories that started mid-August. The decrease in oil inventories is likely linked to decrease in U.S production in the Permian Basin as hurricane Dorian intensified over the past few weeks. Oil price picked up today following the release of the EIA’s number following a price drop linked with the ousting of U.S National Security Advisor, John Bolton.

• Oil gasoline inventories were down as well from last week’s inventory levels. This week, the numbers show a decrease of 682 thousand barrels. The refinery utilization on the other hand pick up moderately and was at 0.3% from last week’s level. Demand for oil stood at 10.4 million barrels for the week moderately increasing from last’s week 10.29 million barrels figure.

China

• In china, central bank figures show continuous increase in money supply, M0 money supply year over year growth stood at 4.8%, while M1 year over year growth was at 3.4%. Total M2 money supply was up 8.2% year over year. New yuan loans extended for the period stood at CNY1.2 trillion.