Global real estate activity shows no signs of slowdown

Day in Review

China

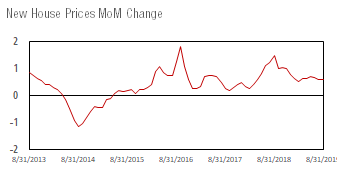

• Demand for new homes continued to push new residential real estate prices up in China, with second and third tier new houses driving the bulk of the growth in price appreciation as first tier new houses see a deceleration in demand. New home prices for the month of August increased by 0.58%, a 9.09% increase year over year. First tier properties in the cities of Beijing, Shanghai, Guangzhou and Shenzhen recorded a monthly increase of 0.3% slightly higher than last month’s 0.2%.

• On a year over year basis, the increase in first tier new house prices was 4.25%. Second and third tier new house prices experienced greater growth compared to first tier prices. Second tier new house prices were up 0.62% and 0.57% month over month. On year over year basis, the increase of 2nd and 3rd tier houses were 9.38% and 9.39%.

• Demand for existing houses was lower than the demand for new houses, particularly in the first-tier existing houses category which experienced decrease in the price of property both on a monthly and yearly basis. First tier existing house prices were down -0.05% on a monthly basis driven by a decrease of prices of -0.4% in Beijing. On a yearly basis, the decrease was around -0.23% driven primarily be price decreases in both Beijing (-0.9%) and Guangzhou (-2%). Existing house prices in 2nd and 3rd tier cities were up 4.94% and 6.3% on a year over year basis.

Japan

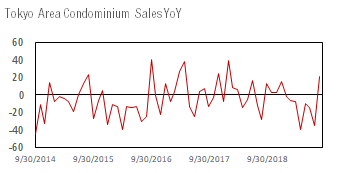

• Condominium sale figures for the month of August show a recovery in the category activity in the Tokyo real estate market. Units for sale increased by 21.1% YoY up from the July figure of -35.3%. The August figure marked the highest increase year to date.

• Units sold were also up 41.5% a positive upbeat following a number of months of negative figures. Units unsold were up 12% YoY, modestly lower than last month’s figure of 13.6% but significantly lower than the year to date high of 27.2% in March showing signs of increasing demand for condominiums in Tokyo.

Germany

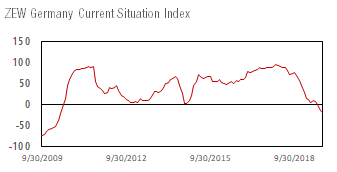

• German investor current situation assessment for the month of September came lower than expected at -19.9 continuing its worsening trend. Last month’s figure was -13.5.

• The current expectations index has dropped to levels not seen since 2010. Future expectations of German investor improved over last month’s figure of -44.1 and came better than expected at -22.5.

• The future expectations index continues to be in negative territory having been positive only once in 2019 during the month of April.

United States

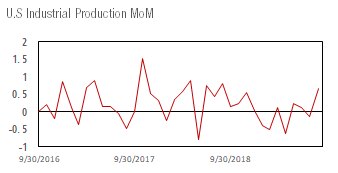

• Industrial production for the month of August picked up after the negative drop of last month. The monthly industrial production increased by 0.6% improving from the -0.2% blip of last month.

• Survey expectations for August industrial production were at 0.2%. Year to date industrial production continues to be in negative territory with an average of -0.06%.

• Manufacturing recorded a monthly industrial production increase of 0.5%, mining production was up 1.4% and utilities was up 0.6%. Reversal in mining and manufacturing production from the negative to positive territory for the month of August supported the growth in overall industrial production reported for the month.

• Meanwhile capacity utilization also came better than expected following a series of months with figures below survey estimates. For the month of August, capacity utilization stood at 77.9% slightly higher than last month’s figure of 77.5%.

• Capacity utilization increased across the board with manufacturing, mining and utilities all recording higher figures than last month. Manufacturing capacity utilization was up to 75.7%, mining capacity utilization was up to 90.5% and finally utilities capacity utilization was up to 76.7%.

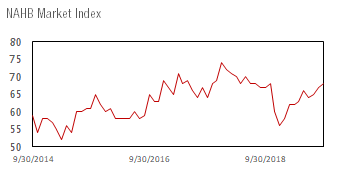

• The highly followed National Association of Home Builders Market Index was up to 68 points in the month of September coming higher than estimates of 66 points.

• The index points to continuous robust activity in the U.S real estate market as builders still believe conditions are good. The September figure is the highest for 2019 coming 5 points higher than the year to date average of 63 points.

• The index increase was supported by builders’ positive view on current single-family house sales which increased to 75 points from last month’s 73 points.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.